The only operated Marginal Field at the time of this report in the State is Oza field in OML-11, jointly owned by Millenium Oil and Gas Limited (60%) in Joint venture with Hardy (20%) and Emerald (20%). The field is being operated under a Risk Service Agreement, RSA, by Decklar Resources.

This exercise has also identified potential marginal fields in the State, though technically classified as partially appraised and unappraised fields, that have remained dormant since discovery by the IOCs as shown in Table 7. Unfortunately, no oil or gas field located within Abia State made it in the 2020/2021 Marginal Field Bid Rounds

Also, given that a new marginal field bid round is being contemplated by the Federal Government, Abia State Government can through its private partnership participate in the next bid rounds.

The State can also consider investing in existing marginal fields assets that have verifiable potentials to acquire non-operating interests: many marginal fields companies from the 2020/2021 bid rounds, are struggling with funding, and therefore are open to negotiate a mutually beneficial package with technical and finance partners to develop the assets, and the State can also take advantage of this to source for funds to jointly develop these assets through its own Abia State Oil and Gas company.

We strongly recommend that the State critically consider these options in view of the downward trend in OML-11, to mitigate against the declining earnings from this aging asset.

Partially Appraised and Unappraised oil and gas discoveries

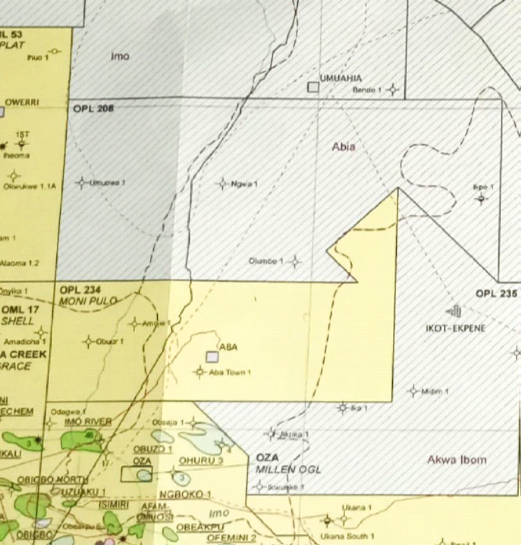

This section presents potential oil and gas assets that are classified as partially appraised and unappraised discoveries located in OML 11, OPL 207, 208 and 234. OPL 208 is straddled between Imo and Abia state, while the administrative boundary of Abia State slightly etched into OPL 235 belonging to OANDO. The Abia side of OPL-235 is not significant to attract further exploration activities.

Tables 7: shows the surface coordinates of the partially appraised and unexplored assets.

| S/N | FIELD | OML /OPL | WELL | X-COORDINATES | Y-COORDINATES | STATUS |

| 1 | Ohuru | OML 11 | Ohuru-1 | 545016.9 | 107138.9 | COMPLETE OIL |

| 2 | OML 11 | Ohuru-2 | 546173.9 | 106956.0 | SUSPENDED | |

| 3 | OML 11 | Ohuru-3 | 545592.2 | 109434.9 | SUSPENDED | |

| 4 | OML 11 | Ohuru-4 | 547315.8 | 108024.4 | PLUG&ABANDONED | |

| 5 | Uzuaku | OML 11 | Uzuaku-1 | 521647.8 | 100450.1 | SUSP OIL&GAS |

| 6 | Ngboko | OML 11 | Ngboko-1 | 542003.7 | 101975.7 | COMPLETE OIL |

| 7 | OML 11 | Ngboko-2 | 541357.9 | 102102.1 | SUSPENDED | |

| 8 | OML 11 | Ngboko-3 | 540354.1 | 103513.0 | PLUG&ABANDONED | |

| 9 | Obeaja | OML 11 | Obeaja-1 | 542821.0 | 111547.2 | PLUG& ABANDONED |

| 10 | Obuzo | OML 11 | Obuzo-1 | 537971.0 | 108734.9 | COMPLETE OIL |

| 11 | Aba Town | OPL 234 | Aba Town-1 | 543354.2 | 120056.9 | PLUG&GAS |

| 12 | Bende | OPL 207 | Bende-1 | 571822.1 | 169153.0 | PLUG&WATER |

| 13 | Ngwa | OPL 208 | Ngwa-1 | 545168.4 | 152303.5 | PLUG&DRY |

| 14 | Olumbe | OPL 208 | Olumbe-1 | 557124.1 | 138852.0 | PLUG&DRY |

| 15 | Ika | OPL 234 | Ika-1 | 565588.9 | 114245.1 | PLUG&GAS |

| 16 | Ikwueke | OPL 234 | Ikwueke-1 | 553356..1 | 101100.0 | PLUG& DRY |

| Tables 7.1 – 7.4, show the prospects contained in these partially appraised and unexplored assets in Abia State. |

| Prospect | Approx Prospect Interval | No of Reservoir | Structural Configuration | Recoverable Reserves(mmbls) | Category | Other Remarks |

| Bende-1 | 500ft | 2-4 | Hanging/footwall Closure | Not Conclusive | High Risk/Low Reward | None |

Table 7.2: Block : OPL 208

| Prospect | Approx Prospect Interval | No of Reservoir | Structural Configuration | Recoverable Reserves(mmbls) | Category | Other Remarks |

| Olumbe | 500 ft | 2-3 | Hanging/footwall closure | Not Conclusive | High Risk/Low Reward | |

| Ngwa | 700ft | 2-3 | Hanging/footwall closure | Not Conclusive | High Risk/Low Reward |

Table 7.3 Block : OPL 234

| Prospect | Approx Prospect Interval | No of Reservoir | Structural Configuration | Recoverable Reserves(mmbls) | Category |

| Aba Town West | 5900-6400ft(intermediate) 700 feet(deep) | 3-5 | Dip Closure/Hanging Wall structure | 2.1-6.3 Hydrocarbon 44NGS in I interval | Low Risk/Low Reward Production Test results 75,000cuft/hr at 6201-6204ft |

| Ika/Ika North | 5900ft | 19-21 | Hanging /Footwall closure | At intermediate level( 8.0mmbls). At Deeper level(43.5mmbls | Medium Risk/Medium Reward |

| Ika Deep | 2000ft | 6-8 | Dip Closure/Hanging wall closure | 5.6mmbls | High Risk/Low Reward |

| Ikwueke | 1000ft | 4-6 | Dip /Hanging wall closure | Inconclusive | High Risk/Low Reward |

Table 7.4: Block : OML 11

| Prospect | Approx Prospect Interval | No of Reservoir | Structural Configuration | Recoverable Reserves(mmbls) | Category | Other Remarks |

| Ohuru | 1800ft | 4 | Simple Anticlinal dip closure. | 47.4mmbls | Partially appraised discovery | Encountered Hydrocarbon |

| Uzuaku | 4000ft(5,700-9700ft ss) | 3-4 | Footwall closure/Anticlinal dip closures and up thrown or downthrown closures. | 7.9mmbls ( where total proven OIIP is 28.9mmbls. | Partially appraised discovery | Encountered 75ft Net Oil Sand(NOS) and 10feet Net Gas Sand. |

| Ngboko | 700-1400feet | 2-4 | Low relief rollover anticline. | 14.90mmbls | Partially appraised discovery | Encountered Hydrocarbon |

| Obuzo | 1500-5000feet | 3 | Simple Anticlinal dip closure and Up thrown or footwall closures which are fault dependent | 14.4mmbls | Partially appraised discovery | Encountered 75ft Net Oil Sand(NOS) and 10ft Net Gas Sand)(NGS |

| Total | 84.6 mmbls |

Given the current state of OML-11, where most of its wells are shut in in Imo River, Isimiri fields, Abia State can pursue the development of the partially appraised and unappraised discoveries within the State that have remained dormant since discovery. These fields are 100% located within the State, and if fully appraised and developed can provide undivided derivation revenue for Abia State.

There are options available to the State – the State government can in partnership with the private sector organize hydrocarbon resource development workshops to discuss how to develop these partially appraised and unappraised discoveries within its boundaries that have remained dormant since discovery. The Government can also partner with a private company to approach the Federal Government to evaluate these fields and add them into the marginal field basket, or the State can with its partners press the Federal Government for concessionary award of these marginal fields to them. Abia State can also, consider setting up its own State Oil and Gas Company that can partner with the Private company to pursue these options with the Federal Government.

Detailed evaluation of these assets will require funding subsurface geoscience, reservoir, petroleum and facilities engineering study and valuation to fully establish their resources, and producibility. We strongly recommend that the State considers these options in view of the declining revenue profile from OML-11.

Figure 15 presents excerpts of concession map showing the wells and fields locations of the partially appraised assets in Abia State, while Figure 16 shows the concession map of OML-11

Figure 15: Concession Map showing field and well locations of the partially appraised assets in Abia State

Figure 16: Location map showing major fields within Abia State in OML 11

Leave feedback about this